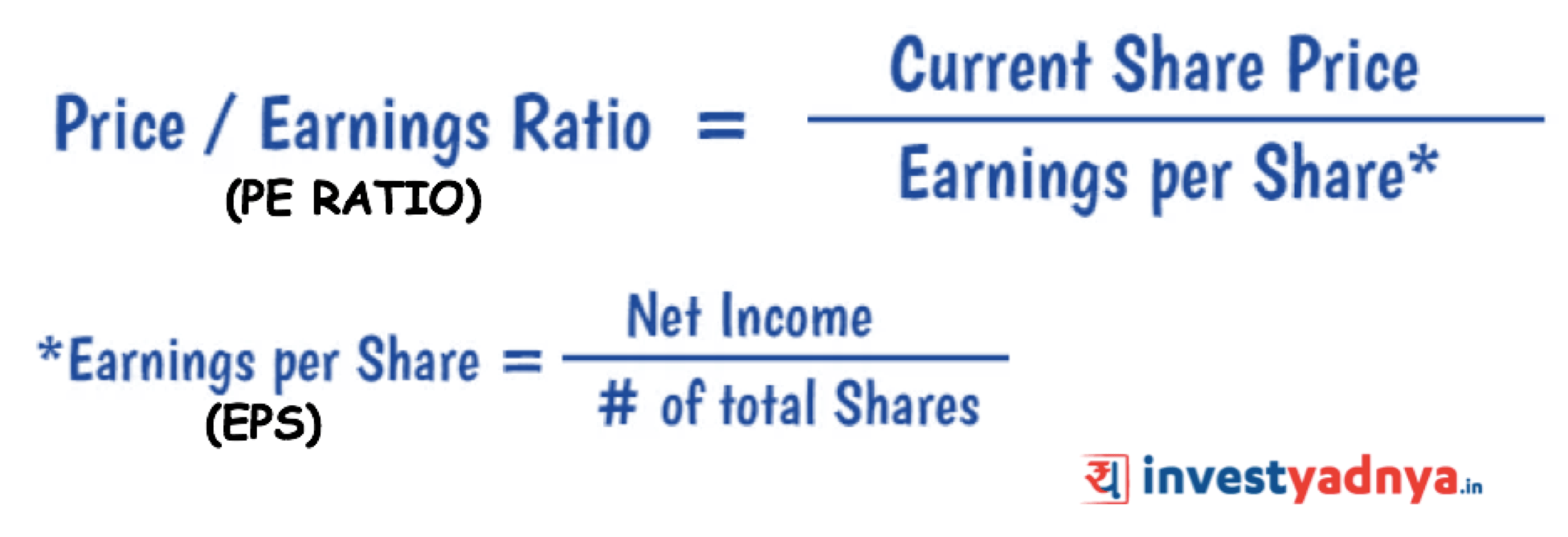

In the United States, since IFRS is the driving force behind the convergence of accounting standards, a knowledge of the key facets of IFRS is helpful to understand the future direction of accounting. According to both IFRS and GAAP, goodwill arises only in a business combination. Until the early 2000s, goodwill was amortized, but changes to both standards switched to a new model that required testing for impairment. But because impairment testing is costly and seems to provide little useful information to stakeholders, both FASB and IASB are currently considering proposals that would allow amortization of goodwill.

The GAAP standard gives organizations the flexibility of choosing the method is most convenient. Under IFRS, the first in, first out (FIFO) inventory valuation method is encouraged. By contrast, GAAP allows the use of the LIFO inventory method, which means that companies using GAAP may end up valuing their inventory differently than businesses using IFRS. Corporate management will profit from modest, efficient standards, rules, and practices that are smeared to all countries and followed worldwide. The change will manage to pay corporate management the opportunity to raise capital via lower interest rates while sinking risk and the cost of doing business. The guiding principle is that revenue is not recognized until the exchange of a good or service has been completed.

Key Differences

The underlying accounting rule that debits must equal credits applies around the world, but precisely how those debits and credits eventually show up in the financials depends on whether your company has to report under U.S. Here in the United States, public companies have to report under GAAP, while around 120 countries around the world use a different set of standards, known as IFRS. Let’s take a look at what those standards mean, and what the main differences are. IFRS does not prioritize liquid accounts in balance sheet lists, so the least liquid assets are listed first, followed by the most liquid ones. Non-current accounts show first, then current assets, followed by owner equity, non-current liabilities, and current liabilities.

The convergence of IFRS and GAAP to create a single set of accounting standards for worldwide use has been taking place, in some form, for decades. However, we’re still some distance from the US Securities and Exchange Commission (SEC) actually making the switch from GAAP to IFRS. Ultimately, IFRS vs. US GAAP is an issue that businesses will need to deal with for the foreseeable future. Both accounting standards recognize fixed assets when purchased, but their valuation can differ over time. The following discussion highlights specific differences between the two sets of standards that may be useful to users of financial statements.

LIFO Inventory

IFRS has a de minimus exception, which allows lessees to exclude leases for low-valued assets, while GAAP has no such exception. The IFRS standard includes leases for some kinds of intangible assets, while GAAP categorically excludes leases of all intangible assets from the scope of the lease accounting standard. This is an asset category specific to IFRS which does not exist in GAAP.

- The Revenue Recognition Standard, effective 2018, was a joint project between the FASB and IASB with near-complete convergence.

- However, it also covers areas that are disclosure-based, such as segment reporting.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

- Under GAAP, balance sheet assets are reported in descending order of liquidity, with current assets at the top.

- IFRS and GAAP differ in how much flexibility they allow when interpreting accounting rules.

By market we mean the market value and we define it as equal to the current replacement cost. However, we should remember that the market value cannot be greater than NRV and lower than NRV less normal profit margin. The convergence process is designed to figure out the significant differences between IFRS and US GAAP that need improvement. However, some differences will still continue to exist between the two systems. We have some articles based on the IFRS vs US GAAP differences to help you get more details about the IFRS vs US GAAP differences.

Differences between US GAAP vs IFRS

However, the standards differ in the mechanics of calculating impairment losses, and whether impairment losses can be reversed. Financial reporting standards and requirements differ by country, which makes variations in financial reporting. Generally accepted accounting principles (GAAP) is the accounting standard set by the Financial Accounting Standards Board (FASB) for the Securities and Exchange Commission IFRS vs. U.S. GAAP (SEC) in the United States. It’s a rule-based system that all domestic and Canadian publicly traded companies must follow when filing financial statements. The purpose of GAAP is to help investors analyze financial data and compare different companies to make informed financial decisions. Generally accepted accounting principles, or GAAP, is promulgated by the Financial Accounting Standards Board (FASB).

Sumitomo Mitsui Financial : UNAUDITED QUARTERLY CONSOLIDATED JAPANESE GAAP FINANCIAL STATEMENTS AS OF AND FOR THE THREE MONTHS ENDED JUNE 30, 2023 – Form 6-K – Marketscreener.com

Sumitomo Mitsui Financial : UNAUDITED QUARTERLY CONSOLIDATED JAPANESE GAAP FINANCIAL STATEMENTS AS OF AND FOR THE THREE MONTHS ENDED JUNE 30, 2023 – Form 6-K.

Posted: Fri, 18 Aug 2023 10:23:10 GMT [source]

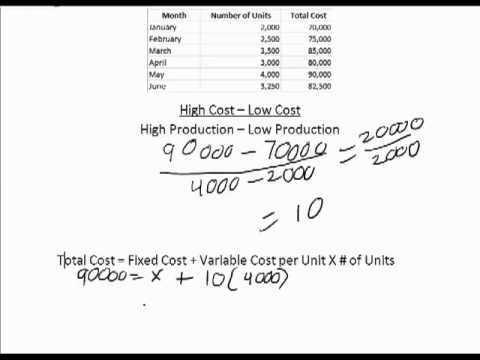

Both GAAP and IFRS allow First In, First Out (FIFO), weighted average cost, and specific identification methods for valuing inventories. Under GAAP, Last In, First Out (LIFO) is also permitted, but LIFO isn’t allowed under IFRS. While both methods allow write-down of inventory values if the fair market value decreases, only IFRS allows reversal of those write-downs if the market value later recovers. GAAP takes a more conservative approach, while inventory values can be more volatile under IFRS.

July 2023 IASB meeting notes posted

The two crucial accounting systems have a few dissimilarities that may distress the results. All accounting schemes follow double-entry practices that classify transactions as revenue or expenses, assets or liabilities. If you understand a petite about both IFRS vs US GAAP, you can make a superior evaluation of numbers from companies that follow neither system. GAAP specifies that dividends paid be accounted for in the financing section, and dividends received in the operating section. When following IFRS standards, companies have a choice of how they categorize dividends. Dividends paid can be put in either the operating or financing section, and dividends received in the operating or investing section.

Neptune Reports Fiscal First Quarter 2024 Financial Results – MENAFN.COM

Neptune Reports Fiscal First Quarter 2024 Financial Results.

Posted: Fri, 18 Aug 2023 00:31:24 GMT [source]

GAAP has no such blanket exception, but allows organizations to establish a materiality threshold in their accounting policies for capitalization. Another difference is that ASC 842 retains a distinction between operating leases and finance leases while IFRS 16 classifies all leases as finance leases. For example, current assets are displayed first in GAAP, while IFRS reports begin with non-current assets. One of the reasons IFRS does not support LIFO is that it’s impossible to achieve accurate inventory flow using this method. This may result in an inaccurate income amount that does not paint an accurate picture.

This is at a broad, framework level; differences in accounting treatments for individual cases may also be added as this gets updated. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

An Overview of GAAP vs. IFRS

If you’re a preparer, it may help you identify areas to emphasise in your financial statements; if you’re a user, it may help you spot areas to focus on in your dialogue with preparers. GAAP requires that long-lived assets, such as buildings, furniture and equipment, be valued at historic cost and depreciated appropriately. Under IFRS, these same assets are initially valued at cost, but can later be revalued up or down to market value. Any separate components of an asset with different useful lives are required to be depreciated separately under IFRS. Under GAAP, development costs are expensed as incurred, with the exception of internally developed software.

In addition, IFRS requires separate depreciation processes for separable components of PP&E. For US GAAP, all property is included in the general category of Property, Plant and Equipment (PP&E). Under IFRS, when the property is held for rental income or capital appreciation the property is separated from PP&E as Investment Property. However, adjusted EBITDA will be included in a separate reconciliation section rather than directly showing up on the actual income statement.

- Under U.S. GAAP, when a reliable estimate of total costs cannot be determined until the contract is finished, the completed contract method is used.

- Prior to founding FloQast, he managed the accounting team at Cornerstone OnDemand, a SaaS company in Los Angeles.

- Likewise, the updates to lease accounting under GAAP and IFRS (ASC 842 and IFRS 16, respectively) share a common framework, but have a few differences.

He was formerly with BP America Inc., where he managed the preparation of consolidated external financial statements that were converted from IFRS to US GAAP. He has specialized in IFRS in the facets of conversion, application, and policy and serves on the IFRS AICPA SAG. In the US, under GAAP, all of these approaches to inventory valuation are permitted, while IFRS allows for the FIFO and weighted average methods to be used, but not LIFO. Three methods that companies use to value inventory are FIFO, LIFO, and weighted inventory. For professionals in non-accounting roles, understanding what’s behind an organization’s numbers can be immensely valuable.

Table of contents

They want to protect the interests of investors who have resisted adopting IFRS. SEC believes IFRS lacks consistency and does not support addressing smaller reporting issues. While there are several differences between GAAP and IFRS principles, there are some similarities as well.

In GAAP, acquired intangible assets (like R&D and advertising costs) are recognized at fair value, while in IFRS, they are only recognized if the asset will have a future economic benefit and has a measured reliability. One of the key differences between these two accounting standards is the accounting method for inventory costs. Under IFRS, the LIFO (Last in First out) method of calculating inventory is not allowed. Under the GAAP, either the LIFO or FIFO (First in First out) method can be used to estimate inventory. The primary difference between the two systems is that GAAP is rules-based and IFRS is principles-based.

All domestic public companies based in the US must adhere to the US GAAP system of accounting. Under IFRS, interest paid and dividends paid are classified as operating or financing activity, but according to U.S. GAAP interest paid is an operating activity, and the dividend paid is a financing activity. Both interest received and dividends received can be classified as operating or investing activities.

Reversal of impairment losses under IFRS are capped at the asset’s initial carrying amount. Likewise, the updates to lease accounting under GAAP and IFRS (ASC 842 and IFRS 16, respectively) share a common framework, but have a few differences. IFRS has a de minimus exception, which allows lessees to exclude leases for items with a value under $5,000.